Deal Analysis and Tips for Trading the British Pound

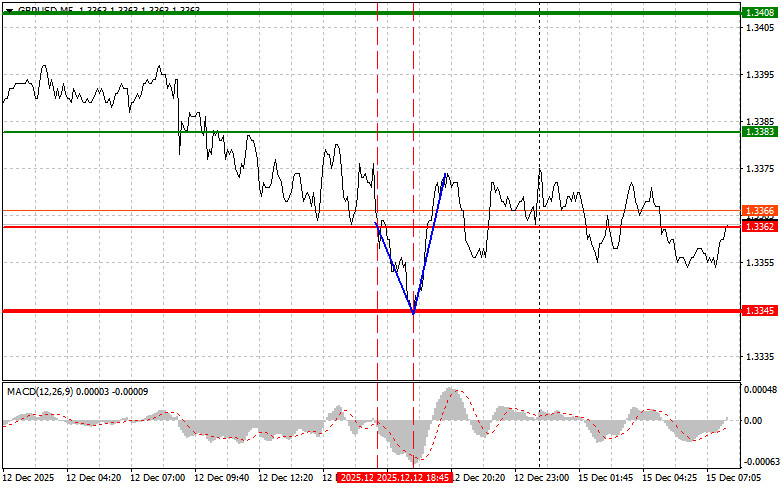

The test of the price level at 1.3362 occurred as the MACD indicator began to move downward from the zero mark, confirming a good entry point to sell the pound. As a result, the pair decreased by more than 17 pips. Long positions on the bounce from 1.3345 allowed for an additional profit of about 20 pips from the market.

The pound only slightly declined against the US dollar. This relative stability of the British currency can be attributed to several factors. Firstly, the market has already partially priced in expectations regarding a further pause in the Bank of England's rate-cutting cycle, as high inflation in the UK continues to put pressure on the central bank, forcing it to maintain a tight monetary policy. Secondly, some decent economic data released recently has supported the pound.

Going forward, the dynamics of the GBP/USD pair will be determined by several factors, including future decisions from the BoE and the Federal Reserve, macroeconomic data from both countries, and the geopolitical situation. It is important to remember that markets are influenced by news and participant sentiment, so investors should remain vigilant and consider all factors when making decisions.

Today, in the absence of UK macroeconomic data, participants in the GBP/USD market have the opportunity to resume upward momentum. With no economic reports being published from the United Kingdom, the market is free to speculate and potentially strengthen the British pound, especially if positive sentiment regarding risk assets on currency markets is maintained.

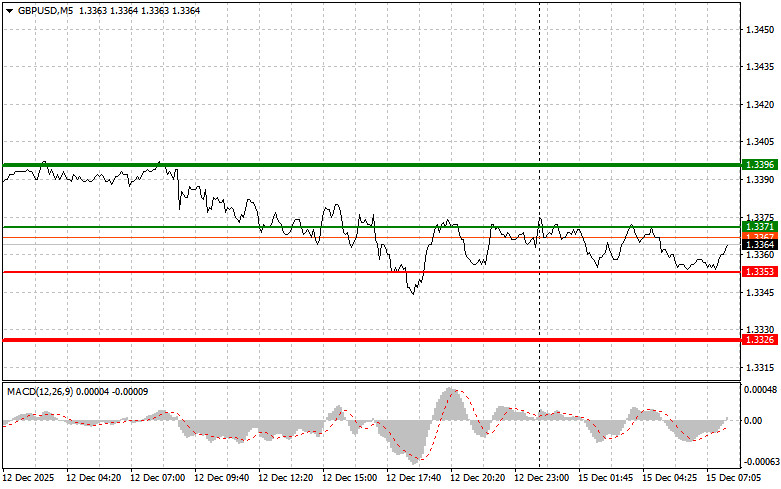

As for the intraday strategy, I will primarily rely on the implementation of scenarios #1 and #2.

Buy Scenarios

Scenario #1: I plan to buy the pound today when it reaches the entry point around 1.3371 (green line on the chart), targeting a move to 1.3396 (thicker green line on the chart). At 1.3396, I plan to exit my long positions and open short positions in the opposite direction, anticipating a move of 30-35 pips from the entry point. Expecting strong growth for the pound is reasonable as the trend continues. Important! Before buying, ensure the MACD indicator is above the zero mark and just starting an upward move.

Scenario #2: I also plan to buy the pound today if the price level at 1.3353 is tested twice consecutively while the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward market reversal. A rise towards opposite levels of 1.3371 and 1.3396 can be expected.

Sell Scenarios

Scenario #1: I plan to sell the pound today after the 1.3353 level is broken (red line on the chart), which will trigger a rapid decline in the pair. The key target for sellers will be the 1.3326 level, where I intend to exit my shorts and immediately open longs in the opposite direction, anticipating a 20-25-pip move back from that level. Pound sellers will try to continue the pair's correction. Important! Before selling, ensure the MACD indicator is below the zero mark and just starting its downward move.

Scenario #2: I also plan to sell the pound today if the price level at 1.3371 is tested twice consecutively while the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline towards opposite levels of 1.3353 and 1.3326 can be anticipated.

What's on the Chart:

- Thin green line – entry price at which you can buy the trading instrument;

- Thick green line – estimated price where you can set Take Profit or take profit yourself, as further growth above this level is unlikely;

- Thin red line – entry price at which you can sell the trading instrument;

- Thick red line – estimated price where you can set Take Profit or take profit yourself, as further decline below this level is unlikely;

- MACD Indicator. When entering the market, it is essential to be guided by overbought and oversold zones.

Important: Beginner traders in the Forex market need to make entry decisions with great caution. It is best to stay out of the market before significant fundamental reports to avoid sudden price fluctuations. If you choose to trade during news releases, always set stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for the intraday trader.