The GBP/USD currency pair failed to show any decisive movement on Friday—it neither rose nor fell significantly. Many analysts interpreted the U.S. labor market and unemployment data as positive simply because the numbers weren't worse than expected. However, from our perspective, that's a weak consolation for the dollar. Yes, Nonfarm Payrolls slightly exceeded forecasts, but most of the previous U.S. data releases were disastrous, and the March NFP figure was revised downward. True, the unemployment rate didn't rise—but since when has the absence of deterioration been considered a strong positive factor? The problem is that the market is ignoring genuinely positive factors for the dollar. They are overshadowed by the negative sentiment created by Donald Trump, who continues to push for a revision of trade relations with half the world. Trump believes this new trade policy will strengthen the U.S. economy over time. Experts—including us—strongly doubt that. And the market appears to agree.

Therefore, the U.S. dollar can only count on a technical correction at this stage. We do not believe that last week's appreciation of the dollar was triggered by positive fundamentals or macro data—simply because there were none. In the absence of any new escalation in the global trade war, the market has likely started to take profits on short dollar positions. What we are seeing is a correction.

Only the Federal Reserve and Bank of England meetings matter in the upcoming week. Even these events—typically triggering 100–200 pip moves—may now be easily overlooked. The Fed is highly likely to leave the key rate unchanged. Jerome Powell and his colleagues are not hurrying to draw conclusions and are prepared to adjust monetary policy based on concrete macroeconomic changes—not speculative fears. Powell is watching for rising inflation, slowing growth, and increasing unemployment, but the real question is how bad the situation will get. If the U.S. economy slows down modestly, that's one thing. If it enters a prolonged recession, that's another.

The BoE, however, is likely to cut its key interest rate by 0.25%. It hasn't rushed into monetary easing so far, but with inflation slowing in the UK, there's little reason to keep the rate unchanged. Accordingly, the BoE is expected to cut rates while the Fed does not—a factor that favors the U.S. dollar. However, the question is whether the market is ready to respond to this or is content for now, simply closing out dollar shorts and continuing to trade based on Trump. In recent months, market movements have been anything but logical, and there's no guarantee that will change this week. The pound has barely held below the moving average and hasn't even broken its latest local high.

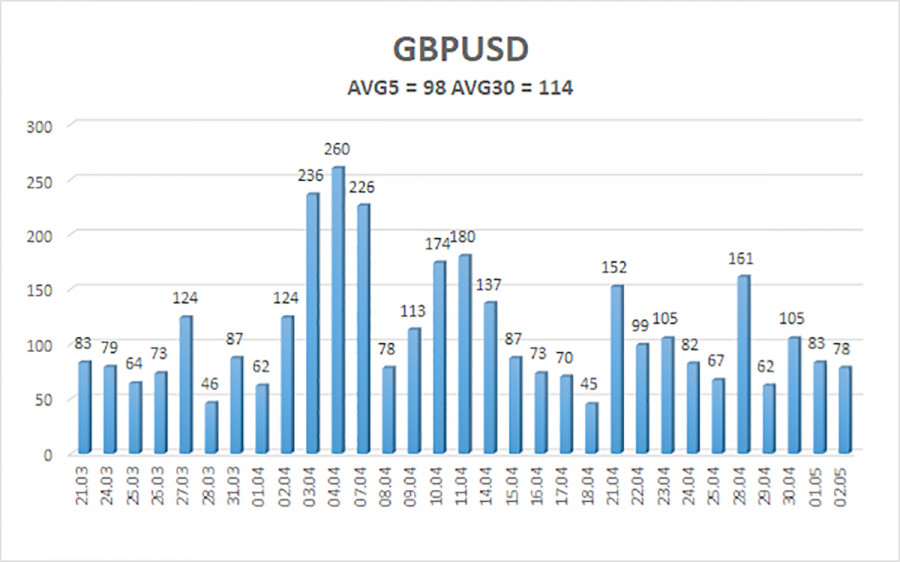

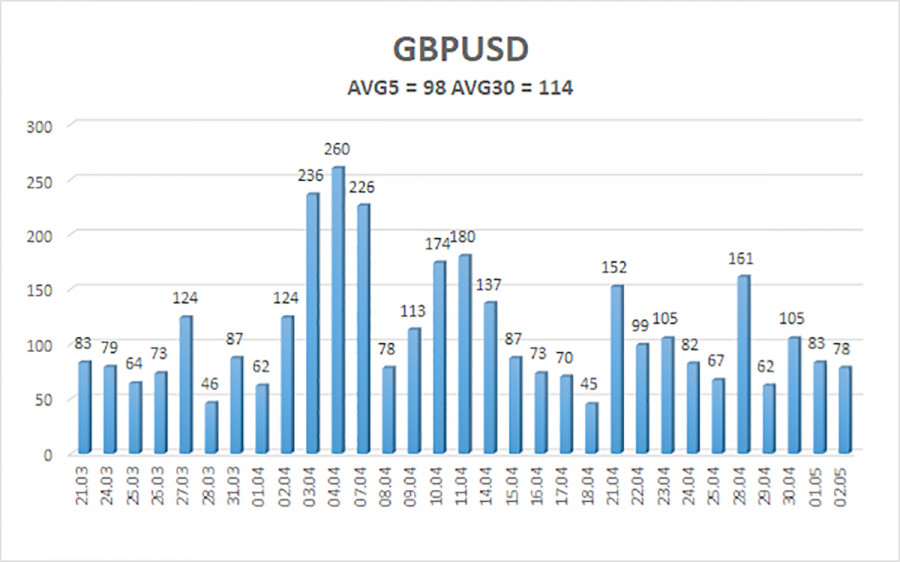

The average volatility of GBP/USD over the last five trading days stands at 98 pips, which is considered "average" for the pair. On Monday, May 5, we expect movement within a range bounded by 1.3167 and 1.3363. The long-term regression channel is pointing upward, indicating a clear bullish trend. The CCI indicator has formed a bearish divergence, which triggered the current decline.

Nearest Support Levels:

S1 – 1.3184

S2 – 1.3062

S3 – 1.2939

Nearest Resistance Levels:

R1 – 1.3306

R2 – 1.3428

R3 – 1.3550

Trading Recommendations:

The GBP/USD pair maintains a bullish trend but has settled below the moving average. We still believe there's no strong reason for the pound to rise. It's not the sterling gaining strength, but rather the dollar weakening—for two months now. And this decline is entirely Trump-driven. Therefore, Trump's actions can just as easily trigger a sharp downward move—or a renewed rally. If you're trading based purely on technical signals or Trump headlines, long positions remain relevant above the moving average, with targets at 1.3428 and 1.3550. Short trades are still appealing, with initial targets at 1.3184 and 1.3167. The dollar's four-day rally is already surprising many—it appears we are witnessing a technical correction.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.