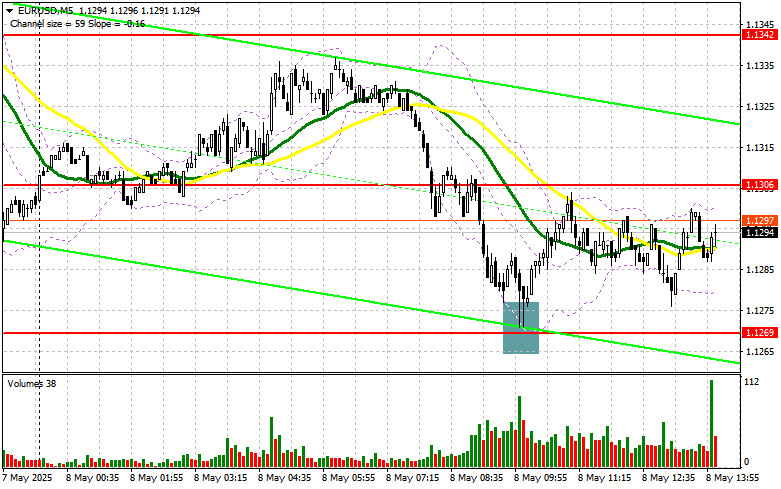

In my morning forecast, I focused on the 1.1269 level and planned to make market entry decisions from it. Let's take a look at the 5-minute chart and analyze what happened. A decline followed by a false breakout around 1.1269 led to a long entry on the euro, resulting in a 30-point rise in the pair. The technical picture was not revised for the second half of the day.

To open long positions on EUR/USD:

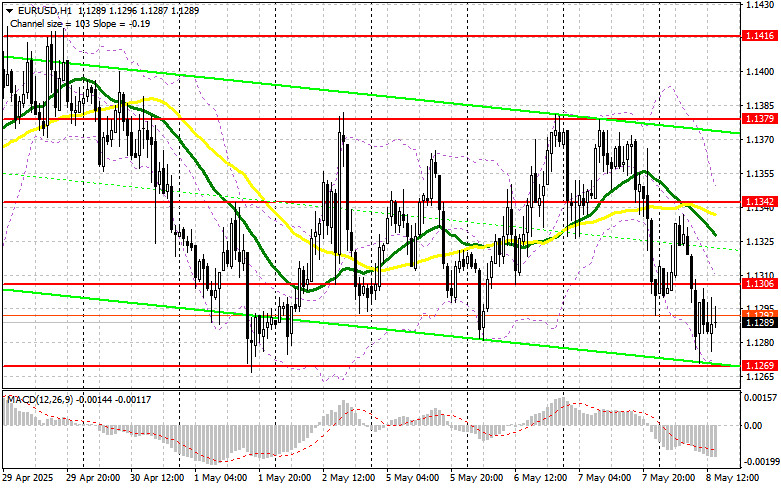

Strong industrial production data from Germany failed to help the euro deal with the pressure that mounted yesterday after the U.S. Federal Reserve left interest rates unchanged. There are no significant U.S. statistics in the second half of the day, so the euro may get a brief respite. Data is expected on weekly initial jobless claims, nonfarm productivity, and unit labor costs. If the data is strong, the euro will likely continue to fall, shifting the focus again to defending the nearest support at 1.1269. A false breakout there, as analyzed earlier, will be a reason to buy EUR/USD with the prospect of recovering to the 1.1306 level, which was missed earlier in the day. A breakout and retest of this range will confirm a valid entry point with a move toward the 1.1342 level. The most distant target will be 1.1379, where I plan to take profit.

If EUR/USD declines and there is no activity near 1.1269, pressure on the pair will increase, potentially triggering a sharper drop. In that case, bears could reach 1.1219. Only after a false breakout at that level will I consider buying the euro. I also plan to open long positions from 1.1164 immediately on a rebound, targeting a 30–35-point intraday correction.

To open short positions on EUR/USD:

Euro sellers have proven their presence in the market and are aiming for the lower boundary of the sideways channel. A breakout from this range would establish a new bearish trend. If the euro rises after the data, bears will have to reaffirm their dominance around 1.1306. Only a false breakout there will be a reason to short with a target at 1.1269. A breakout and consolidation below this range will provide a suitable selling opportunity with a move toward 1.1219. The most distant target will be 1.1164, where I plan to take profit. A test of this level would break the bullish market structure.

If EUR/USD moves higher in the second half of the day and there is no strong selling activity at 1.1306, buyers may drive the pair to 1.1342, where moving averages are located, now acting in favor of the bears. I'll sell from that level only after a failed consolidation. I plan to open short positions immediately on a rebound from 1.1379, targeting a 30–35-point correction.

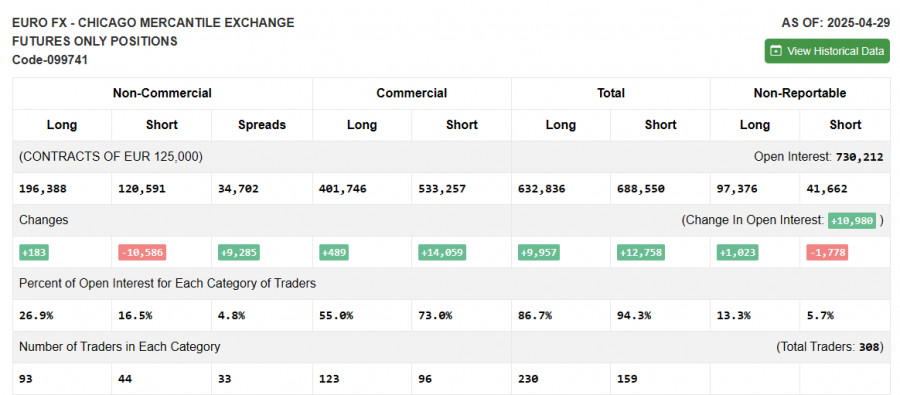

COT (Commitment of Traders) Report:

The COT report for April 29 showed a rise in long positions and a decline in shorts. Since the European Central Bank still plans to cut interest rates further, this remains a limiting factor preventing the euro from returning to a bull market. The upcoming Fed meeting is expected to leave borrowing costs unchanged, which plays in favor of the U.S. dollar and will continue to support it. According to the COT report, non-commercial long positions rose by 183 to 196,388, while short positions dropped by 10,586 to 120,591. As a result, the gap between longs and shorts increased by 9,285.

Indicator Signals:

Moving Averages: Trading is below the 30- and 50-period moving averages, indicating further downside for the pair.

Note: The author's moving average periods and prices are based on the H1 chart and may differ from classical daily MAs on the D1 chart.

Bollinger Bands: In case of a decline, the lower boundary of the indicator around 1.1269 will act as support.

Indicator Descriptions:

- Moving Average: Identifies the current trend by smoothing out volatility and noise. Period – 50 (yellow), 30 (green).

- MACD: (Moving Average Convergence/Divergence) Fast EMA – period 12, Slow EMA – period 26, SMA – period 9.

- Bollinger Bands: Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes.

- Non-commercial long positions: The total long open interest held by non-commercial traders.

- Non-commercial short positions: The total short open interest held by non-commercial traders.

- Net non-commercial position: The difference between short and long positions held by non-commercial traders.