On Thursday, the EUR/USD currency pair continued to trade within the same sideways channel, clearly visible on the hourly chart, almost until the evening. As we warned, the outcome of the Federal Reserve meeting did not change anything. The US dollar slightly strengthened a few hours after the announcement, but this rise had no real impact. It was so predictable that it hardly requires any discussion.

The first important point is that the market ignores fundamental and macroeconomic data. Based on that alone, one could have expected that there would be no major price changes on Wednesday evening or Thursday morning. Of course, we allowed for the possibility of being wrong, since market sentiment can shift, but this time we were right. So, regardless of the Fed's decision, the dollar was doomed to remain stuck in a range.

The second important point is that it is physically difficult for the dollar to rise—no one is buying it. Even if the Fed had raised the key interest rate (which was practically impossible), we still would not have expected a strong rally in the dollar. It's worth noting that Jerome Powell again took the most hawkish stance possible. He stated that economic uncertainty is off the charts, so it's not the time for hasty decisions. He also suggested that there may not be a single rate cut in 2025 due to rising inflation.

We mentioned this at the beginning of the year, when everyone expected 3–4 rate cuts, while the Fed's dot plot showed only two. We warned that the Fed's top priorities remain inflation and labor market stability. It's not that the Fed isn't concerned about the economy, but everyone understands who and what caused the slowdown of the U.S. engine. The economic downturn isn't Powell's problem—it's Trump's. He created it, and it's his to fix.

Incidentally, Donald Trump has already commented on the Fed's decision, calling Powell "a clueless fool who's always late." From our viewpoint, Powell effectively fulfills his duties and upholds the Fed's dual mandate.

The third important point is that the market doesn't want to trade right now, neither up nor down. And once again, Trump is the reason. Market participants have no idea what the president's next moves will be in the ongoing trade battles, or with which parties he might reach an agreement. Remember: the market doesn't care about deals with Serbia or Israel. It monitors opportunities involving major economic players, specifically the European Union and China. And as of now, no negotiations are taking place with either. Therefore, nobody is rushing to buy dollars right now.

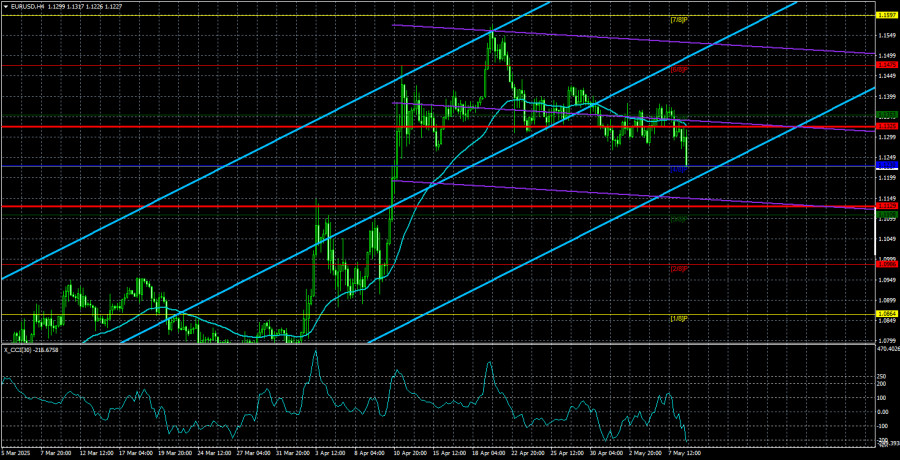

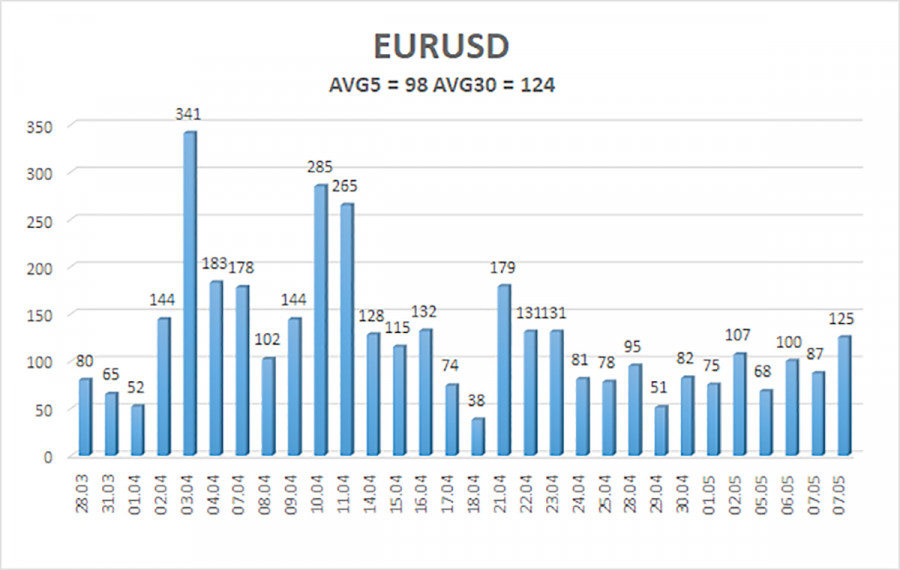

The average volatility of the EUR/USD pair over the last five trading days as of May 9 is 98 pips, which qualifies as "average." We expect the pair to move between 1.1129 and 1.1325 on Friday. The long-term regression channel is pointing upward, indicating a continued short-term uptrend. The CCI indicator has recently entered overbought territory three times, each leading only to a minor correction.

Nearest Support Levels:

Nearest Resistance Levels:

Trading Recommendations:

EUR/USD has begun a new leg of downward correction within a broader uptrend. For months, we've consistently maintained that the euro will likely fall in the medium term, and nothing has changed. The dollar still has no reason for a sustained rebound—except for Donald Trump. However, that one reason alone may continue pulling the dollar down while all other market drivers are ignored. If you're trading on pure technicals or based on Trump-related moves, long positions remain relevant as long as the price is above the moving average, with a target of 1.1475. If the price falls below the moving average, short positions are appropriate with targets at 1.1129 and 1.1108. The flat range ended yesterday.

Explanation of Illustrations:

Linear Regression Channels help determine the current trend. If both channels are aligned, it indicates a strong trend.

Moving Average Line (settings: 20,0, smoothed) defines the short-term trend and guides the trading direction.

Murray Levels act as target levels for movements and corrections.

Volatility Levels (red lines) represent the likely price range for the pair over the next 24 hours based on current volatility readings.

CCI Indicator: If it enters the oversold region (below -250) or overbought region (above +250), it signals an impending trend reversal in the opposite direction.