Trade Analysis and Advice on Trading the British Pound

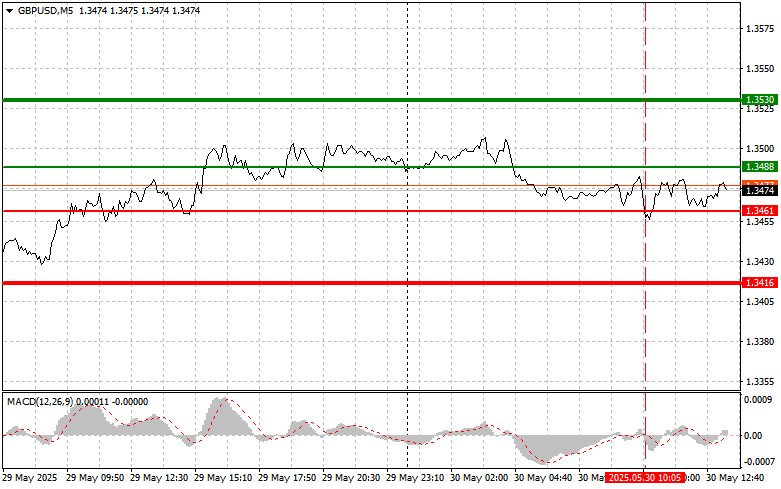

The price test at 1.3461 during the first half of the day occurred when the MACD indicator had just started moving downward from the zero mark, confirming a correct market entry point. However, losses were recorded as the downward movement did not materialize.

The pound remained within the channel. In an environment lacking fresh news, market forces tend to consolidate, and technical levels gain greater importance. Traders, deprived of new catalysts, tend to stick to established trading ranges, which was observed today in the pound's dynamics. I hope things will change in the second half of the day.

We are expecting data on changes in U.S. household spending and income levels, which are key indicators of consumer activity and the country's economic health. Growth in spending, supported by rising incomes, signals strong consumer demand, which in turn stimulates economic growth. Additionally, the University of Michigan Consumer Sentiment Index will be released—a barometer of consumer optimism and future confidence. A high index suggests consumers are ready to spend, positively impacting retail sales and overall economic growth.

However, the main movement is expected after the release of the Personal Consumption Expenditures (PCE) Price Index. A significant deviation from expectations could lead to a surge in volatility. A rise in the index would likely support the dollar. The day will conclude with remarks from FOMC member Raphael Bostic, whose comments on the current economic situation and future monetary policy could significantly influence market sentiment.

As for intraday strategy, I will mainly rely on the implementation of Scenario #1 and Scenario #2.

Buy Signal

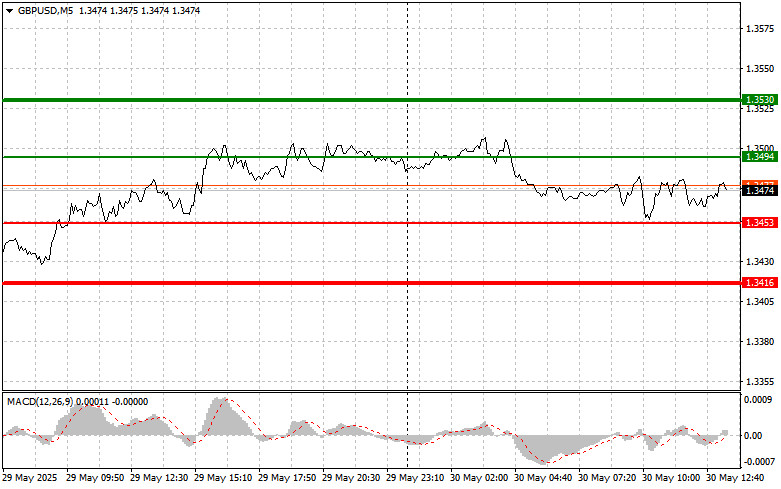

Scenario #1: Today, I plan to buy the pound when the price reaches around 1.3494 (green line on the chart) aiming for growth toward 1.3530 (thicker green line). I plan to exit the market at 1.3530 and also sell the pound in the opposite direction, targeting a move of 30–35 points from the entry point. Pound growth today can be expected after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero mark and just beginning to rise.

Scenario #2: I also plan to buy the pound today in case of two consecutive tests of the 1.3453 level when the MACD indicator is in oversold territory. This will limit the pair's downward potential and lead to a reversal upward. Growth to the opposite levels of 1.3494 and 1.3530 can be expected.

Sell Signal

Scenario #1: I plan to sell the pound after the 1.3453 level is updated (red line on the chart), which would lead to a quick decline of the pair. The key target for sellers will be the 1.3416 level, where I will exit the market and immediately buy in the opposite direction, targeting a move of 20–25 points from that level. Sellers are unlikely to show strong action today. Important! Before selling, make sure the MACD indicator is below the zero mark and just beginning to decline.

Scenario #2: I also plan to sell the pound today in the case of two consecutive tests of the 1.3494 level when the MACD indicator is in overbought territory. This will limit the pair's upward potential and lead to a downward reversal. A decline to the opposite levels of 1.3453 and 1.3416 can be expected.

On the Chart:

- Thin green line – the entry price for buying the trading instrument;

- Thick green line – the approximate price for setting Take Profit or manually fixing profit, as further growth beyond this level is unlikely;

- Thin red line – the entry price for selling the trading instrument;

- Thick red line – the approximate price for setting Take Profit or manually fixing profit, as further decline beyond this level is unlikely;

- MACD Indicator: When entering the market, it is important to rely on overbought and oversold areas.

Important: Beginner Forex traders must exercise great caution when making market entry decisions. It is best to stay out of the market before the release of important fundamental reports to avoid sharp price fluctuations. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember, for successful trading, you must have a clear trading plan, like the one presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for intraday traders.