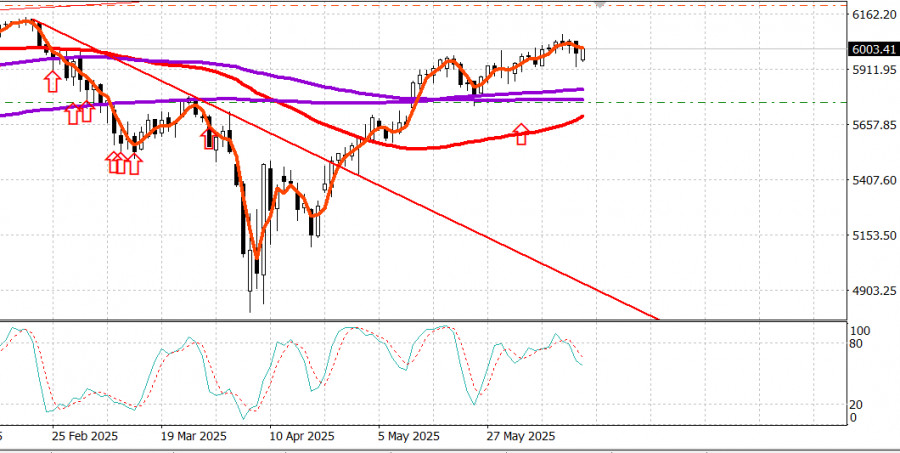

S&P 500

Overview on 16.06

US market amid the Israel–Iran war

Key US indices on Friday: Dow -1.8%, Nasdaq -1.3%, S&P 500 -1.1%, S&P 500 at ,5977, range 5,600–6,200.

The stock market ended the week on a weak note, as concerns over the war between Israel and Iran outweighed fears of missing out on further stock gains.

The S&P 500 lost 1.1%, retreating 0.4% for the week, while the Russell 2000 (-1.9%; -1.5% for the week) and Dow (-1.8%; -1.5% for the week) performed even worse.

Stocks opened Friday with declines after Israel launched an overnight strike on Iranian nuclear facilities.

Israel's attack and subsequent retaliatory strikes by Iran on Israel triggered a spike in oil prices, while stocks opened lower but managed to recover steadily during the first half of the session, continuing this week's overall resilience.

The S&P 500 eventually recovered more than half of its early morning losses but ultimately dropped again, pressured by renewed selling amid signs that the Middle East conflict is likely to escalate over the weekend.

President Trump urged Iran to return to nuclear talks or face further aggression from Israel. However, CNBC reported earlier in the day that Iranian officials no longer plan to participate in the nuclear talks scheduled for Sunday. Shortly after, Iran launched a barrage of missiles at Israel, leaving little hope for de-escalation in the coming days.

All ten sectors closed the day in negative territory, with financials (-2.1%) and technology (-1.5%) at the bottom of the leaderboard.

Payment companies such as Visa (V 352.85, -18.55, -5.0%), PayPal (PYPL 70.83, -3.98, -5.3%), and Mastercard (MA 562.03, -27.25, -4.6%) led declines in the financial sector amid concerns they could lose some business if retail giants Amazon (AMZN 212.10, -1.14, -0.5%) and Walmart (WMT 94.44, -0.39, -0.4%) launch their own stablecoins, which could happen soon according to The Wall Street Journal.

The technology sector also struggled, with chipmakers leading the weakness as traders rushed to take profits after a strong week.

The PHLX Semiconductor Index fell 2.6% on the day, though it still ended the week up 1.5%. Most other tech components also posted losses, while solar stocks such as Enphase Energy (ENPH 45.60, +0.91, +2.0%) and First Solar (FSLR 175.12, +7.29, +4.3%) helped offset some of the sector's weakness.

The sector's poor performance overshadowed Oracle's (ORCL 215.22, +15.36, +7.7%) continuation of yesterday's rally following earnings, as shares hit a new all-time high.

Some defense stocks, including Northrop Grumman (NOC 516.72, +19.59, +3.9%) and Lockheed Martin (LMT 486.45, +17.18, +3.7%), also showed relative strength, though the iShares US Aerospace & Defense ETF (ITA 180.22, +0.75, +0.4%) ended with only a modest gain.

The energy sector (+1.7%) outperformed throughout the day, boosting its weekly gain to 5.7%, as crude oil surged $5.12, or 7.5%, to $73.16 per barrel, finishing the week up $8.57 or 13.3%.

Treasuries spent the session retreating steadily from a slightly higher open, as rising oil prices reignited inflation concerns.The 10-year yield rose seven basis points to 4.42%, as today's developments outweighed the preliminary University of Michigan Consumer Sentiment Index for June (60.5; consensus 53.0), which showed a decline in one-year inflation expectations from 6.6% to 5.1%.

Monday's economic data will be limited to the release of the June Empire State Manufacturing Survey at 8:30 a.m. ET (consensus -6.6; prior -9.2).

Year-to-date performance:

- S&P 500: +1.6%

- Nasdaq Composite: +0.5%

- Dow Jones Industrial Average: -0.8%

- S&P Midcap 400: -3.7%

- Russell 2000: -5.8%

Energy: Brent crude at $74.70 — oil climbed close to $75 amid the Israel–Iran conflict.

Conclusion:We note a very strong consumer sentiment report — the market likely would have risen if not for the pressure from the Middle East conflict. The upcoming Fed rate decision on Wednesday is ahead — but there's virtually no doubt that the rate will remain unchanged. The Israel–Iran war has shaken the outlook. Nevertheless, further growth remains likely.

Makarov Mikhail, more analytics to follow:

https://www.instaforthtex.com/ru/forex_analysis/?x=mmakarov

https://www.ifxmoney.com/ru/forex_analysis/?x=mmakarov